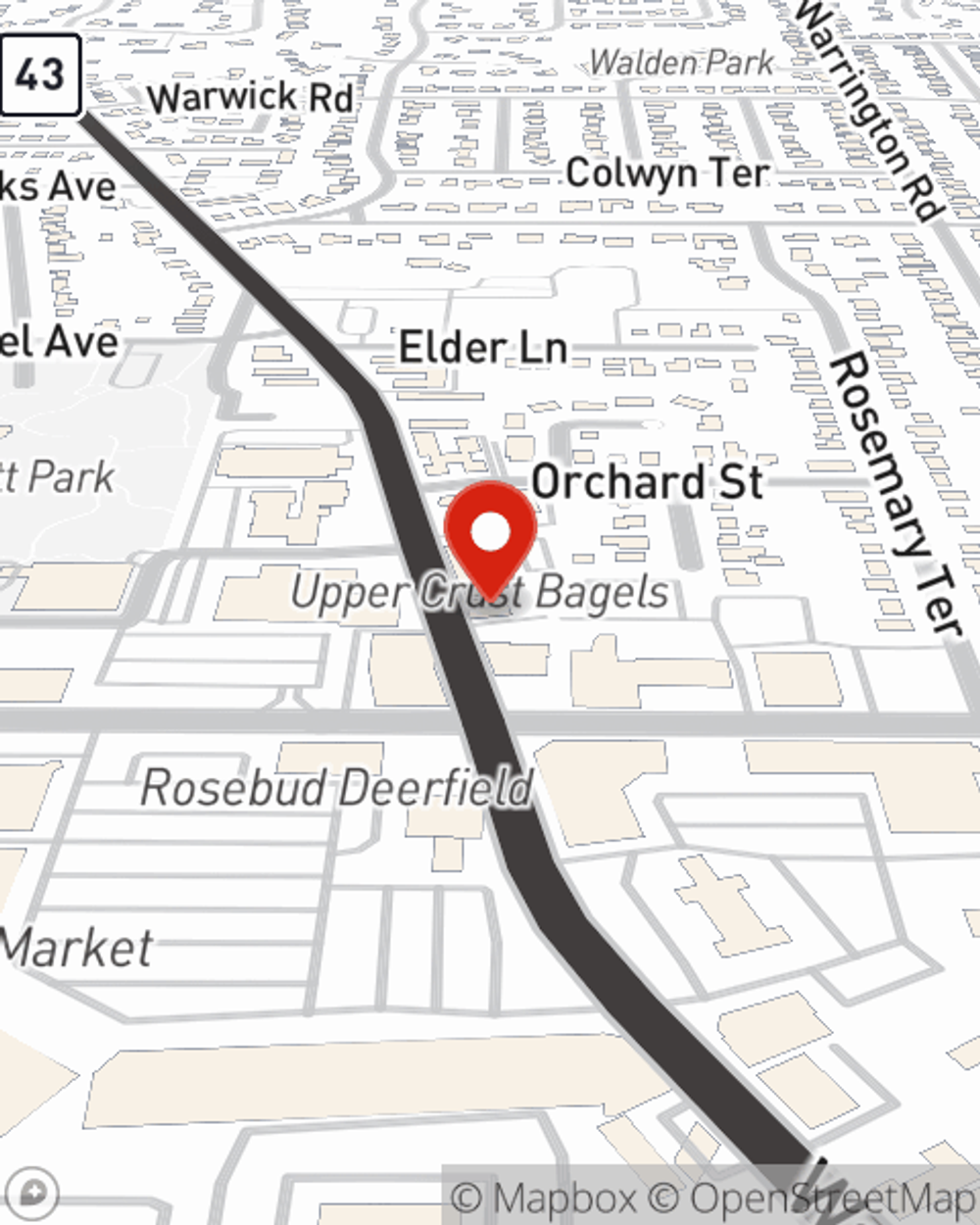

Business Insurance in and around Deerfield

Deerfield! Look no further for small business insurance.

Helping insure small businesses since 1935

This Coverage Is Worth It.

Running a business can be risky. It's always better to be prepared for the unfortunate mishap, like a customer hurting themselves on your business's property.

Deerfield! Look no further for small business insurance.

Helping insure small businesses since 1935

Keep Your Business Secure

Protecting your business from these possible problems is as easy as choosing State Farm. With this small business insurance, agent Michael Rizzo can not only help you construct a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

So, take the responsible next step for your business and visit with State Farm agent Michael Rizzo to identify your small business insurance options!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Michael Rizzo

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.